As a hub for international trade, the Middle East offers immense opportunities is a highly attractive market for exporters worldwide. To succeed, exporters must thoroughly understand the regulations, required paperwork, and approval processes. In this guide, we explore the requirements for exporting to GCC countries—Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the UAE.

The Importance of Being Prepared

Shipping goods to the Middle East entails more than logistics. Exporters must comply with local laws, adapt to cultural norms, and navigate specific approval requirements. Each GCC nation has unique stipulations, making meticulous preparation indispensable.

General Documentation Needed for GCC Exports

While specifics vary by nation, many documents are universally necessary:

1. Commercial Invoice: This document provides details about the goods, their value, and terms of sale. Accuracy and alignment with local customs are critical.

2. Shipment Details List: This document details the size, weight, and contents of each package.

3. Certificate of Origin (COO): Issued by authorized bodies, this document confirms the goods’ origin.

4. Bill of Lading (BOL): An agreement between shipper and copyright outlining the goods’ transport.

5. Import Permits: Regulated items require additional authorization.

6. Meeting Standards and Guidelines: Products must meet technical and safety requirements.

The Role of Key Authorities in Exporting

Each GCC country has specific regulatory agencies responsible for imports and trade. Here are the major regulatory entities for each GCC nation:

Exporting to Saudi Arabia

Saudi Arabia, being the largest economy in the GCC, maintains rigorous import controls.

• Saudi Food and Drug Authority (SFDA): Ensures that health-related goods meet Saudi standards (SASO).

• SASO Standards Body: Certifies that goods adhere to Saudi quality benchmarks.

• Taxation and Customs Oversight: Mandates e-invoices and precise Harmonized System (HS) coding.

Exporting to the Emirates

Exporting to the UAE entails both opportunities and meticulous adherence to rules.

• Dubai Municipality: Mandates bilingual labeling (Arabic and English).

• Oversight by MOCCAE: Focuses on sustainability-related trade regulations.

• FCA’s Role in Import Approvals: Streamlines customs declarations through digital platforms.

Exporting Goods to Qatar

Compliance with Qatar’s trade policies is essential for market entry.

• Qatar’s Trade Ministry Guidelines: Oversees product import standards and certifications.

• dubai chamber of commerce certificate of origin Qatar General Organization for Standards and Metrology (QS): Governs technical standards enforcement.

• Qatar Customs Clearance: Monitors all customs-related activities and paperwork.

Trade Opportunities in Bahrain

Bahrain’s streamlined processes benefit exporters.

• Customs Operations in Bahrain: Oversees trade documentation and clearance.

• Ministry of Industry and Commerce (MOIC): Focuses on promoting business-friendly policies.

• Bahrain Standards and Metrology Directorate: Coordinates with GCC-wide regulatory initiatives.

Navigating Kuwait’s Trade Requirements

Trade with Kuwait emphasizes quality and compliance.

• Kuwait’s Customs Authority: Implements strict import documentation reviews.

• Industrial Oversight in Kuwait: Ensures imported goods meet quality benchmarks.

• Ministry of Commerce and Industry (MOCI): Facilitates product registration processes.

Oman in the overview

Oman’s import process involves:

• The Ministry of Commerce, Industry, and Investment Promotion ensures adherence to local trade standards.

• Directorate General for Standards and Metrology (DGSM): Handles conformity assessments and technical standards.

• The Customs Directorate under the Royal Oman Police supervises customs processes and documentation accuracy.

Important Considerations for Exporting to Specific Countries

Packaging and Labeling Requirements

Each GCC country has unique labeling and packaging requirements:

• Language: Arabic labeling is mandatory, though bilingual labeling (Arabic and English) is often preferred.

• Product labels are required to detail the name, origin, ingredient list, expiration date, and safety notices.

• Packaging: Must meet local environmental regulations, such as biodegradable packaging in Saudi Arabia.

Items Subject to Restrictions or Bans

Certain items are restricted or prohibited in the GCC:

• Goods deemed contrary to Islamic principles are disallowed.

• Items like alcohol and pork are heavily restricted or prohibited in several GCC nations.

• Special approvals are necessary for exporting chemicals and pharmaceuticals.

Custom Tariffs and Duty Charges

Most GCC countries apply a unified tariff system under the GCC Customs Union, typically 5% for general goods. However, exceptions apply for specific items, such as luxury goods or agricultural products.

Difficulties Encountered When Exporting to GCC Countries

1. Respect for cultural differences and business etiquette is essential.

2. The regulatory landscape varies significantly across countries, demanding detailed preparation.

3. Accurate documentation is critical to avoiding delays.

4. Keeping up with changing regulations in the GCC is essential.

Tips for Successful Exporting

1. Working with local representatives helps ease compliance challenges.

2. Leverage Free Zones: Many GCC countries offer free trade zones with relaxed regulations and tax incentives.

3. Employ online systems like FASAH (Saudi Arabia) and UAE e-Services to optimize customs procedures.

4. Seek Professional Assistance: Partnering with trade consultants or freight forwarders can help navigate complex procedures.

Final Thoughts

Entering the GCC market offers vast opportunities but requires detailed planning and awareness of regional specifics.

By maintaining precision in documentation, aligning with local regulations, and utilizing regional resources, exporters can thrive.

With strategic initiatives and proper groundwork, exporters can build a solid presence in the region.

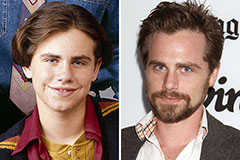

Rider Strong Then & Now!

Rider Strong Then & Now! Christina Ricci Then & Now!

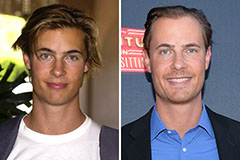

Christina Ricci Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Justine Bateman Then & Now!

Justine Bateman Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now!